Why do we convince ourselves only rich people can afford to save?

Let’s talk about that.

Unlike you and I, rich people believe they deserve to be rich.

The biggest difference between the wealthy and the poor in America is mindset.

Rich people go to private schools. They have drivers, nannies, and cleaners. They get the best teachers and successful parents. They’re told over and over again that they will be successful.

Even if they’re lazy, dumb, or slow, they all start believing its true. They deserve to be rich.

Even when they are in debt, they just call it leverage.

Why is their debt good but yours bad?

You were taught to accept failure…

🤲🏽 If you want to change your life you have to change your strategy, you have to change your story, and you have to change your state. —Tony Robbins

Now let’s talk about your reality. You think about money all the time. Everyone thinks about money all the time.

But you are always negative. You’re thinking about money all the time. You feel stressed out, anxious and exhausted.

When was the last time someone told you that you deserve to be rich, successful and powerful?

Did you grow up hearing that even if you made mistakes, or failed, there would be more chances? Were you taught that you can and will have whatever you want?

Success is waiting for you. Accept it. Wealth is only a matter of time. Eventually you will inherit all of America.

Do you have generational wealth?

I certainly do not. I grew up being told that hard work was the only answer. More hours, more labor, more effort.

If you’re not a success, it is on you. Don’t ask why. Keep your head down and go to work. Get a job. Earn your keep.

Don’t think too much, and definitely don’t talk too much. Shut up and work. Work more. Work harder.

Now you tell me. What kind of mindset is that?

You deserve to learn and earn your own success

🤲🏽 Wealth does not count so much into one’s well-being as the route one uses to get to it. —Nassim Taleb

But here is the truth. The rich are not any better than you.

They had different opportunities. They learned the right mindset. And they expected success.

Here is another truth. You deserve to have the best.

You deserve to be free and to own your time. It’s not too late to change.

So how do you change your mindset?

Imagine for a second that you are a child again.

You have your lunched packed by mom, lace up your shoes, put on your coat, and walk the long walk to class through the morning snow or rain. Whatever the weather was like in fall.

When you get to school, you’re excited to learn your maths, and spelling, and maybe to do some drawing or play football at recess.

But something is a different this morning. Instead of a nice lady who reads story books, and takes a knee to tie your shoe, there is a large pale man in a black suit and tie sitting behind your teacher’s desk.

The big man is bald. He has his shiny leather shoes and you can see them because they are up on the desk. Your teacher would never do that.

But the big man is leaned back, eating an apple. There’s a little bit of white powder on his shirt sleeves, like the snow.

That’s when you notice the quote on the board, written in big bold letters. White chalk on black board.

“Be fearful when others are greedy and greedy when others are fearful.”

Warren Buffet

Imagine if your elementary school books had taught you to count with coins, and multiply by compounding interest on stocks.

Instead you learned to count carrots and peas.

Imagine when you were ten years old, your dad brought you down to the bank, opened your first investment account and bought your first stocks.

You wouldn’t be afraid of the risks of investing.

You wouldn’t scrunch up your face and go cross eyed every time someone mentioned index funds and interest rates.

In fact, savings and investing would all seem so normal, so natural, it wouldn’t even be worth talking about.

When should you buy in to the market?

Here is a dirty little secret: it’s always time to buy stocks when you’re rich. There is no such thing as timing the market.

Financial advisors and money men like to scare you with big words and complex terms. It is literally how they earn their keep.

If your gut tells you not to trust theses money men. Go with your gut on this one.

What’s dollar cost averaging? It is a ridiculous way of saying that you invest the same amount regularly in the same stock. That’s it. It’s that simple.

Doesn’t matter if the price goes up or down. Doesn’t matter if your earnings go up or down. You make a deal with yourself and stick to it.

You do not have change the amount ever. Set it and forget. Thank yourself later.

This table from The Motley Fool caught my eye. It’s always families and the average Americans that are forced to sell, or run from a dip.

There is no need to pay fees, low or high, when it comes to savings and investing.

What you need to do is setup an automated investment, from every single pay check.

20 dollars is fine. 50 dollars is great. Once you start earning more through multiple incomes, save a hundred bucks a week. You can do this. It is not our of reach.

Automatic investing is not some revolutionary technique that I just invented. It’s a simple way of investing in low-cost funds that is recommended by Nobel Laureates, billionaire investors such as Warren Buffett, and most academics…. automating your regular investments so you can sit and watch TV while growing your money.

—Ramit Sethi

This is how rich people think and talk. Seriously.

You can too. Start now. Save ten bucks a week. That’s coffee money. Everyone can earn ten extra dollars a week.

The important thing is to change your mindset. You are creating a new habit.

Stop telling yourself you can’t afford to save. The reality is you can’t afford not to save. Ignore your doubts. Tell the voice whispering negativity in your ear to shut up.

Imagine you had been told since childhood that you deserve to be rich. That you will be rich. And that it’s only a matter of time before you succeed.

So what do you buy?

🤲🏽 Don’t look for the needle in the haystack. Just buy the haystack. John C. Bogle

Honestly it doesn’t really matter. The game is automation and patience. Not. picking stocks or trying to be smart.

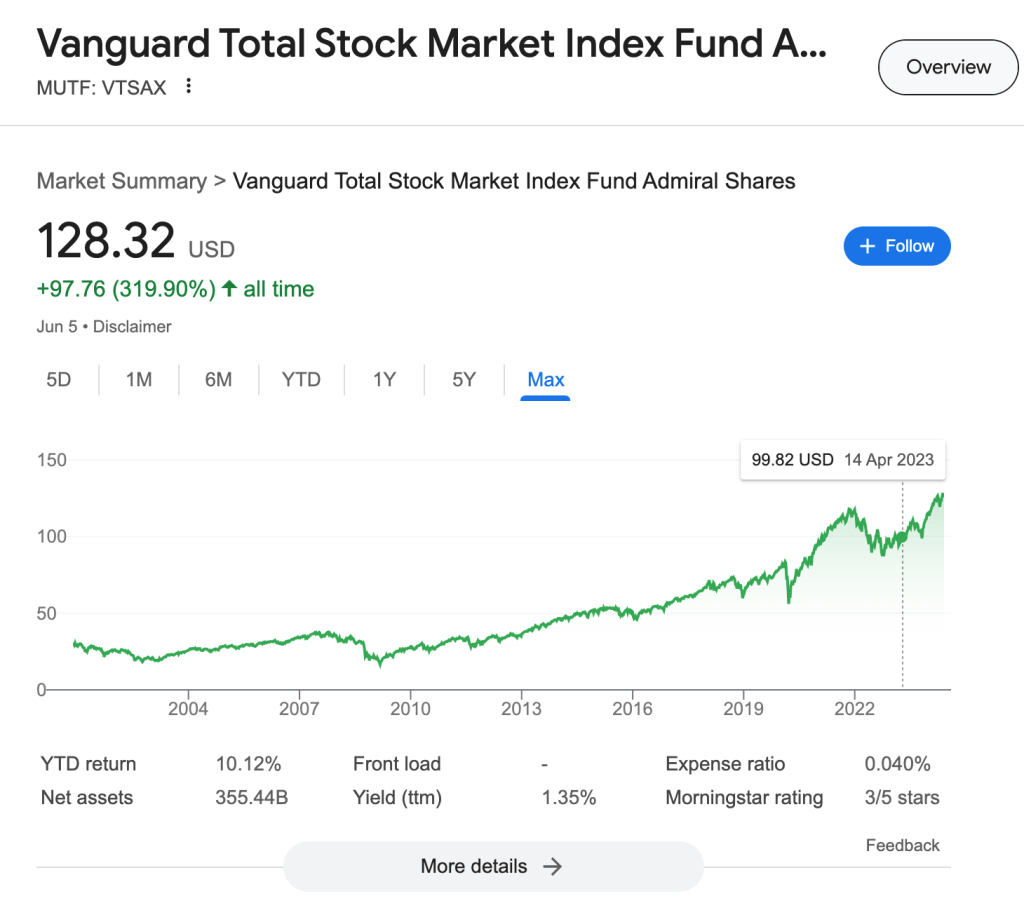

But the go to index funds for most passive investors are Vanguard. They have low rates, large holdings and they are dependable. You get access to over 3500 stocks, and rates that are only a few decimal points.

This raw data off Google reveals the long term trend of US Markets. Sit out the bad weather and ride the wave up and to the right.

Market goes up. Ignore it.

Market goes down. Ignore it.

This is all noise. You focus on learning and earning more. That is a valuable use of your time.

That is my only advice. To set it and forget. It is my plan and my streagy and you can easily do the same.

Learn the basic know how. Earn a bit of extra money with passive income. Invest in your self with an automated savings plan. Sleep better at night.

Cut through all the noise and crap. Do LESS—Learn. Earn. Save. Sleep.

You are going to think about money. Why not think positively?

Because what’s the point of all your hard work, if you can’t sleep well at night.

🌊 My mission: I will teach you how to do LESS.

I believe everyone can learn to earn, save, and sleep well with financial freedom.

Thanks for reading.

I write copy & content. I teach courses. I show up everyday.

But I do LESS. Learn. Earn. Save. Sleep.

Leave a comment