When it comes to spending we constantly worry about the what. But what if it’s the why that matters?

Let’s talk about that.

My family went a lot of unusual places. We were always travelling for my Dad’s work. Far off, exotic places, where we sometimes spent weeks.

But most of our time away from home was spent sitting by a hotel pool. Or holed up in the hotel room, enjoying the A/C and TV while he disappeared for hours or days at a time.

The reason we went as a family was supposedly to see the world. But the reality was that we went to spend time with each other. Just like at home, our favourite activities were the creature comforts of the familiar.

If we stop to ask why most of us spend, the answers are often surprising. Most of us don’t like to admit we are hopelessly addicted to caffeine, alcohol and sugar. Or that we are vain.

Who wants to keep wearing the same old pair of shoes?

How about that shiny new car?

Will it actually make you feel like a new you?

Think about the next big purchase you’ve been dreaming about: will it add value to your life, or are you trying to plug a psychic hole with a wad of cash?

So you’re having trouble saving? Join the club.

🤲🏽 I drive old cars, all my Patagonia clothes are years and years old, I hardly have anything new. I try to lead a very simple life. I am not a consumer of anything. And I much prefer sleeping on somebody’s floor than in a motel room.

Yvon Chouinard, Patagonia billionaire founder

The coolest basketball shoes when I was growing up were Ewings. This probably dates me for a lot of you.

I grew up before the dominant Air Jordan era, when not everyone wanted to be like Mike.

I was no different than anyone else. I longed for a new pair of Ewings in each color: purple, orange, red, blue.

But I couldn’t live without an orange pair. I drew pictures of them in the margins of my schoolwork. I tabulated how many lemonades I’d have to sell. How much I’d have to steal from the Unicef collection boxes.

Then one day in September a kid named Colin walked into class wearing a pair of black Ewings. I was shocked.

Everyone said Colin was the poorest, dirtiest kid at school. It didn’t make sense that he could afford the coolest new basketball shoes.

I had been so wrong about Colin and the shoes. We had all been so wrong. Our assumptions had made us look like idiots. Everyone in class immediately changed their minds.

Colin was not the poorest kid. We were obviously the poor kids, not him. We didn’t have Ewings yet. The evidence of our own poverty was right there on his feet in patent black leather.

Everything I had thought up till that moment was a lie. I needed a black pair of Ewings.

Mom, can I pretty please have a new pair of shoes?

🤲🏽 Our never-ending search for stimulation is often an attempt to hide our fears.

—Thibuat Muerisse, Dopamine Detox

My mother was not impressed.

An old hippy, she used to make our healthy lunches and dinners based on a hand written cue card system she kept on the back of the kitchen cupboard door.

The family’s weekly spending money was divided into cubbies on the back of her bedroom door. Bills. Gas. Groceries. There was even on for Friday night Movie money, which we had to wait four days to spend.

There was no cubby for new Ewings.

Mom frowned the whole time I was talking about Colin’s beautiful new black shoes. She was spreading peanut butter and raisins into celery sticks for an after school snack.

Eventually I finished explaining to her her that my life would basically be over, if I she didn’t buy me a new pair of shoes.

My mom frowned and asked me a simple question, which has never left me:

Do you know why Colin’s family is poor?

I Will Teach You to Be Rich(er), but I got dumber first…

🤲🏽 Keeping up with friends is a full-time job. Too often, our friends invisibly push us away from being conscious spenders.”

Ramit Sethi, I Will Teach You to Be Rich

I’d like to tell you that I never made the same mistake as Colin’s family. But that just wouldn’t be true.

I have blown lots of money over the years on poor spending habits.

In my 20s, I worked nights at a bar. I made hundreds of dollars a week in cold hard cash tips— tax free income!

But I literally didn’t count that money as my earnings.

I told myself it was bonus money. So I blew all that hard earned cash going out for drinks after work, socializing with fast friends and buying more crap.

But once I started making a real salary as a Teacher & Educator, I learned from my past mistakes. Right?

Nope!

I started a so-called collection. Pretty soon I had a closet full of sports jerseys, baseball caps, and sneakers, I couldn’t wear to work, or dinner.

None of this sports crap was that expensive. I could easily justify the cost of any single purchase. A hundred bucks here. Another fifty.

What difference did it make?

But the real issue was that I was trying to make up for a lack in my childhood by spending. I wasn’t thinking long term. I had no financial plan.

Because mom never bought those black Ewings. Or I never listened. I was impulse buying clothes and shoes.

But they weren’t adding value to my life.

These purchases were just a cheap thrill. A short term dopamine hit that never changed my actual mental or physical health.

And that superficial spending habit cost me huge potential savings.

Before you read any farther, ask a friend…

I would never have changed my spending habits if I didn’t hit rock bottom.

I had $60,000 in student debt, a $20,000 line of credit, and $10,000 plus in maxed out credit cards. My debt was more than double my yearly income.

But you don’t have to let your personal finances get that bad.

Let’s try a thought experiment. Start a conversation with a friend you can trust today.

Ask them if they have something they buy to make up for something they couldn’t have or weren’t allowed as a kid.

It’s normal if they are worried about sharing, or admitting to a bad spending habit to you. So share your own story first.

The spending habit can be anything, from ice cream to fancy socks.

What about the jet ski collecting dust in your garage over winter?

Or that piano no one plays?

The point is to talk about why you are spending that money. It’s not about what you are buying.

Who Decides What’s Important and What’s Crap?

🤲🏽 “THE PROBLEM IS THAT HARDLY ANYONE IS DECIDING WHAT’S IMPORTANT AND WHAT’S NOT, DAMMIT!

—Ramit Sethi, I Will Teach You to Bee Rich (again)

I know, know I shouldn’t just quote the same book again. But I really want to emphasize this point. And I flat out refuse to write in all caps.

So I figured I would just steal Ramit’s cringe to yell about your bad spending.

After you have talked with a friend about your one bad spending habit, you need to make a system to check yourself before you the next time you buy.

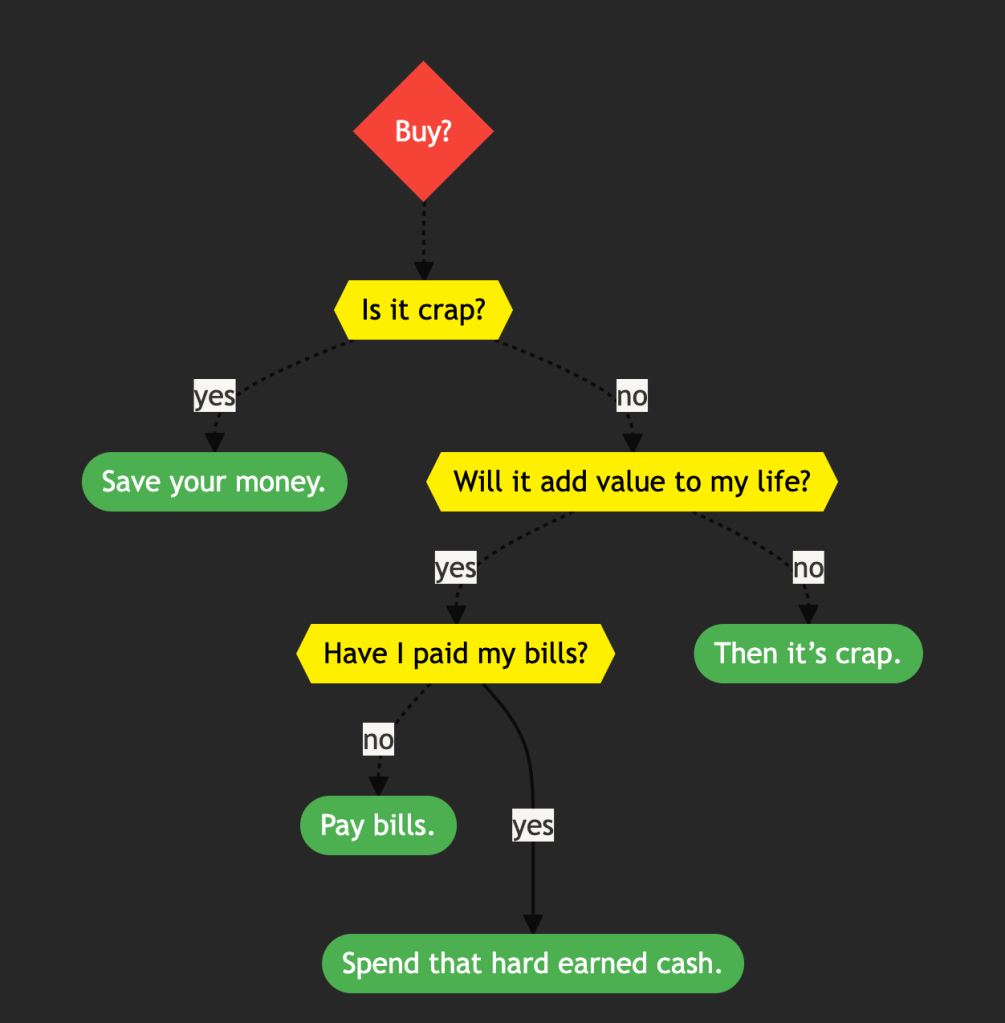

Let’s create a solution. I’ve made simple workflow and ladder that forces me to actively think before spending.

To make this work, it has to be so simple that you can draw it on a napkin. You can screengrab the one below and set it as your phone’s desktop background.

If you can’t remember the steps in your head, your system is too complicated. Our goal is to make the choice easy.

Here’s what I came up with and use to make sure I am not passively spending my hard earned cash.

My Active Spending Decision Tree

The point is to think before you buy. Don’t just run your default on dumb dopamine hits.

🌊 My mission: I will teach you how to do LESS.

I believe everyone can learn to earn, save, and sleep well with financial freedom.

Thanks for reading.

I write copy & content. I teach courses. I show up everyday.

But I do LESS. Learn. Earn. Save. Sleep.

Leave a comment