Is your house a safe investment?

Let’s talk about that.

You always hear that there’s another real estate bubble around the corner.

But the same financial advisors say you cant lose investing in real estate.

The average American family considers their house to be their primary investment.

And they better because most folks still owe the bank a quarter million dollars of mortgage debt.

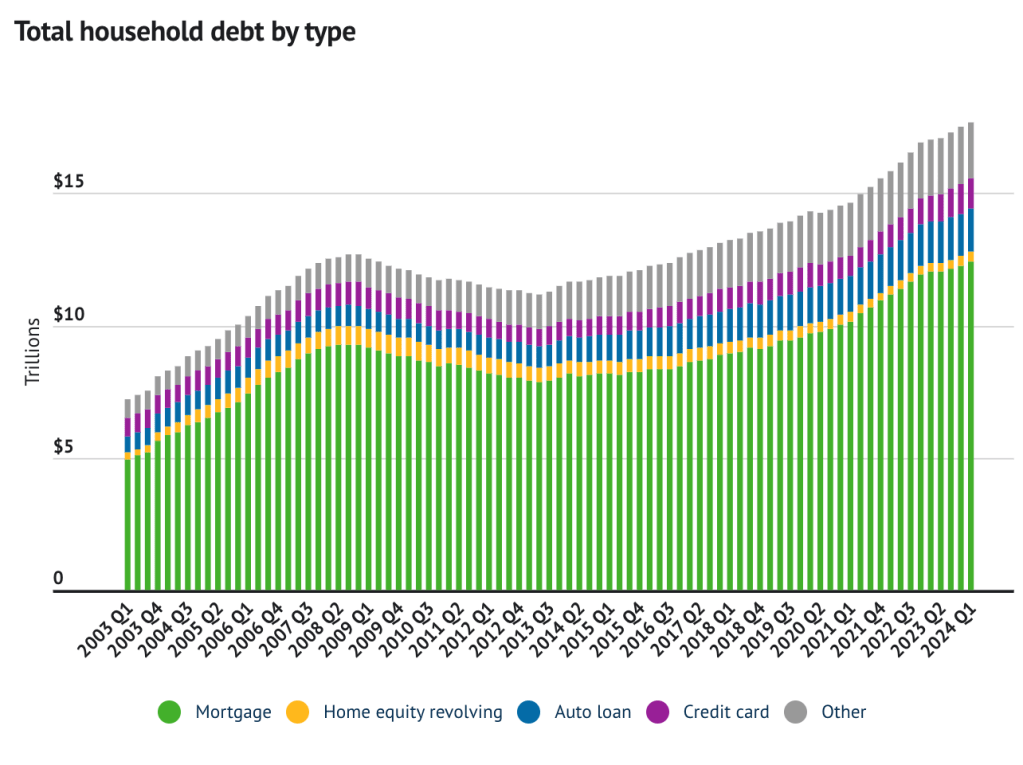

Americans owe over twelve trillion dollars in debt on our homes.

I found this table on The Motley Fool, and was blown away by the huge numbers. Funny how they make mortgage debt green.

But are we actually in debt? Or are we leveraged for our future?

Everyone knows interest rates are going up.

The cost of home ownership is eating up a bigger portion of your monthly budget.

Housing might be up in value. But it is also up in cost.

It makes you wonder…

Is there another housing crisis on the horizon?

But our population is up too. There’s more of us Americans than ever.

And so housing prices are going up for now.

But a lot of first time buyers and remortgaged homes are locked in at low interest rates.

Thanks pandemic.

For most Americans, their home is their biggest “investment,” and yet, as investments go, your primary residence is not a very good one for individual investors.

Why?

Because the returns are generally poor, especially when you factor in costs like maintenance and property taxes—which renters don’t pay for, but homeowners do.

Ramit Sethi, I Will Teach You to Be Rich

So when does our so called good debt become bad debt?

The problem is that most of us don’t actually know how to calculate profit on our homes. That’s because there is a serious financial literacy gap in America.

And even if you understand how the finances work, most of you will not actually sell your home.

And if you do sell you still won’t downsize then pocket the profits in capital gains.

In fact, your more likely to remortgage or borrow against the additional value of your house.

You can call that leverage if you want, but you’re actually more in debt than ever.

Ask: How much is your mortgage actually costing you?

The average American’s mortgage payment is way up.

Almost $3000 a month.

But the average salary is hovering around 50k.

Run the numbers. You get mortgage costs equal to 72% of income.

That’s way too much to pay. You cannot afford to have more than 70% of your income going to housing.

That’s an unsustainable budget.

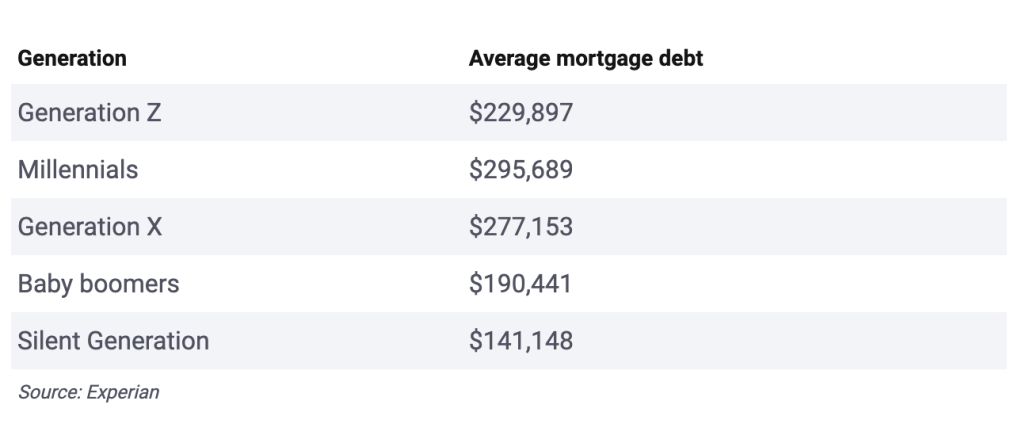

The cost and size of mortgages aren’t equal. Millennials and Gen Zs are more likely to be house poor.

But the median mortgage payment is a little under $1800, a more manageable amount.

So let’s go with that number. It adds up to $21600 in mortgage payments a year.

For most of you, somewhere between 20-40% of your take home earnings is spent on a housing debt.

In other words, most of us can still afford our homes.

And that’s a good thing. As Americans, we are probably not looking at an epic 2008 level housing crash any time soon.

The country is on stable ground for now.

But like I said before, not everyone in America is equal. And neither are their mortgages.

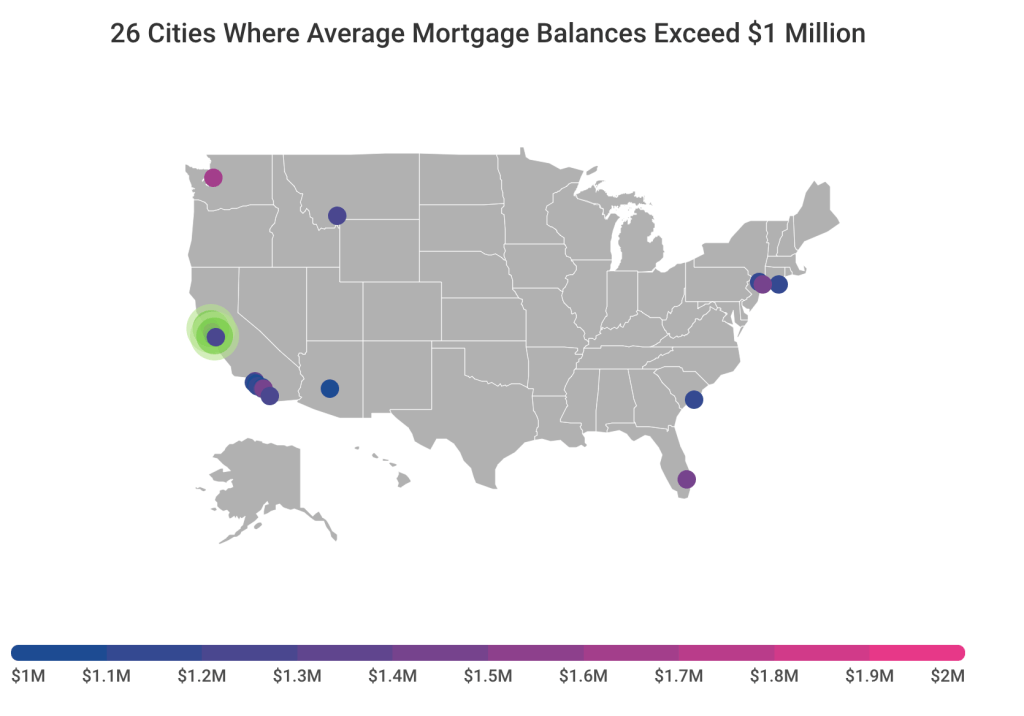

The cost of owning a home on the coast is a real concern.

I found this diagram on Experian that shows how average mortgages have ballooned in California and New York.

In many American cities, the cost of housing has climbed so high that the average home mortgage is a million dollars.

I hate to break it you, but having an enormous mortgage does not make you a millionaire.

That’s delusional. And depending on your income, that enormous mortgage might be bad debt.

Is your house a good long term savings plan?

Most people confuse their house with an investment that they buy and sell for profit.

Think about it. Who sells their house for profit and keeps the money?

If your parents ever sold their house, did they move into a smaller house and enjoy the rest of that money?

No!

They rolled it over to the down payment for their next, more expensive house.

Ramit Sethi, I Will Teach You to Be Rich

The simple truth is that buying and flipping houses on a mortgage is not a reliable investment.

House flipping is speculative.

Because of interest rates and mortgage terms, you will have paid of very little of your principal in less than a decade.

For years, most of your mortgage payment goes straight to interest.

If you buy and sell in the first 5 to 7 years of a long term mortgage, you will likely lose money on your home.

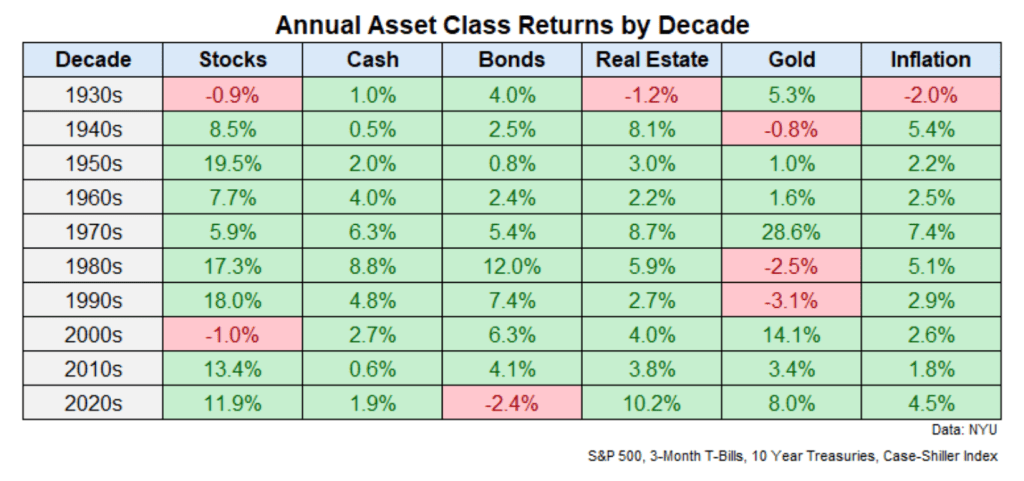

Look at this great chart from A Wealth of Common Sense, showing just how profitable and reliable long term investments in the American stock market have been.

🤲🏽 Each person has to play the game…in a way that takes into account his own psychology.

—Charlie Munger

Take a step back and look at the amount you would have made keeping your savings in real estate over the course of any decade in the last century.

The results are pretty lousy.

The 1940s and 1970s are outliers for investing in real estate.

Only twice in a century could you make an 8% return on buying and selling real estate over a ten year stretch.

But stocks return over 10% per decade, on average.

The market had massive returns for multiple 20 year stretches, if you can weather the storm of a downturn.

Worst of all, it seems very unlikely that real estate growth in the first half of the 2020s can be sustained for the next 5 years.

And these numbers are not adjusted for inflation.

But there is short term money to be made in real estate through leverage.

Let’s say the price of your house rockets up from 250 to 300k in five years. And you only put a 20% down payment of 50k.

The result: you just made 50k on 50k. That’s 100%.

I’m not saying people don’t make quick cash in the real estate market. But remember, real estate is a risky place to keep your savings.

But is owning still better than the rent trap?

If losses are going to make you miserable—and some losses are inevitable—you might be wise to utilize a very conservative pattern of investment and saving all your life.

So you have to adapt your strategy to your own nature and your own talents.

—Charlie Munger, Poor Charlie’s Almanack

Sometimes we are dumber than we think we are.

But why?

Because we overestimate our own ability and intelligence.

Psychologists call this the Dunning Kruger effect. It’s human nature to assume you are smarter and quicker than everyone else.

Meaning you think you’re better than average.

But so do I. And so does everyone else reading.

The best advice is often simpler than we think.

So don’t over think this one. The short answer is, yes.

Buying is still better than renting, especially if you plan on living in your new home for 10 to 20 years.

So how much can you afford to pay for your first home?

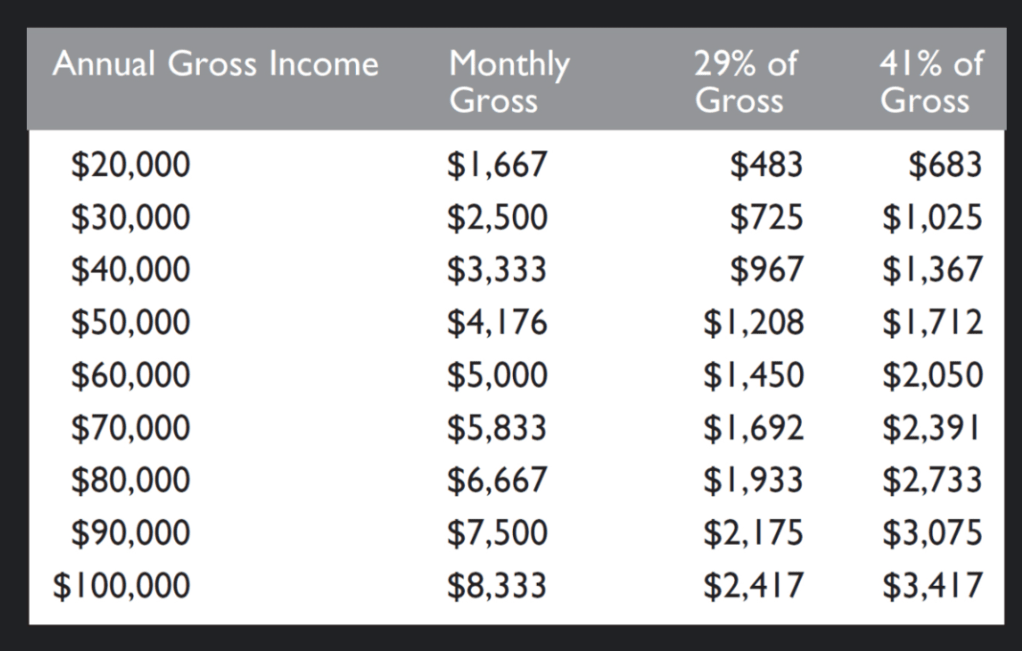

Check out this handy table from The Automatic Millionaire by David Bach. He already ran all the numbers for you.

If your household income is average, you can afford to pay $1700 a month on housing.

That’s about 40% and perfectly reasonable…just don’t move to California or New York.

So if you are thinking of buying to become a first time home owner, do it now.

There are tons of government programs made for you.

First time buyers can often get 95-100% of the purchase cost financed.

Yes, I said 100%.

Just google FHA loans, and learn how you can stop paying rent and start being an owner.

Are you a first time home buyer?

Ask for help. Learn about the first time buyer financing.

Pay yourself rent instead of someone else. Don’t wait to pay off your other debts.

And get started on doing LESS—Learn. Earn. Save. Sleep.

For some of you, pretty soon you’ll be sleeping well in your first home.

🌊 My mission: I will teach you how to do LESS. I believe everyone can learn to earn, save, and sleep well with financial freedom.

Thanks for reading.

I write copy & content. I teach courses. I show up everyday.

But I do LESS. Learn. Earn. Save. Sleep.

Leave a comment