Why do personal finance books have terrible titles like I will teach you to be rich?

Let’s talk about that.

“I Will Teach You to Be Rich” by Ramit Sethi has the kind of crappy, clickbait title that turns a lot of people off.

But today I want to revisit some of this bestsellers personal finance lessons and see how they have aged.

Don’t get me wrong. This is a great book. Ramit offers us a simple, easy to use financial planning system.

But some of the ideas haven’t aged well. His extravagant spending justifications are just plain wrong.

Paying a therapist a hundred bucks a week would be cheaper than justifying the 5000 dollar a year shoe addiction.

Some of Ramit’s conscious spending advice is nonsense. He is telling us what we want to hear. Not reality.

With that kind of cash, you could have financed a million dollar home in a decade. I’ll run the numbers on how that works later.

But back when it was published, in 2009, after the biggest Wall Street crash in a hundred years, this insightful book challenged conventional wisdom.

Americans were hungry to know more about personal finance.

Ramit struck a chord with a lot of us.

Who wouldn’t want to learn how to be rich after the subprime mortgage crisis?

The housing market went up in flames. Then the American economy turned into an asset incinerator.

I Will Teach You to Be Rich picks up where David Bach’s Automatic Millionaire left off.

Ramit expertly breaks down complex financial concepts into simple, actionable steps. He claims you can achieve his rich life by following a straightforward 6 week plan.

The 3 key steps:

- Automate your money into defined investment and savings accounts.

- Practice conscious spending habits

- Work towards achieving a “rich life”.

But how do you define your rich life?

Ramit zagged against the normal idea of stacking zeros in your bank account. His new rich is a rebrand as more of a lifestyle design.

The new rich is not a dollar or asset amount.

His rich life is having financial freedom. You spend your time and money on what truly matters to you.

It’s a nice, clean and customizable package.

But let’s dig a little deeper.

The idea is that rich has come to mean something like financial freedom, or maybe even contentment. Rich is the happiness always on the horizon.

This leap solves a simple problem: most of us will not be rich in the sense of achieving that top 1% of wealth in America.

Let’s not bullshit ourselves here.

You and I probably won’t bank the 5.8 million dollars it takes to be a true one percenter.

The harsh fact is that 99% of us won’t ever be that rich.

The harsh fact is that 99% of us won’t ever be that rich.

So why bother trying?

Well, I Will Teach You To Be Rich basically says:

You can change your habits. Change your goals.

Then find your own rich life. It’s a customizable financial freedom that ditches the old one size fits all approach.

This speaks to me.

The rich life clearly picks up on Tim Ferris’ new rich from The 4 Hour Work Week. The New Rich figure out how to make money do less work, but earn more and save more time to live their dreams now.

I’m a semi-retired teacher. I live in a beach community in Asia with my wife and kids. I never had to save millions to achieve my new rich life.

In fact, I never used the FIRE method or 4% or any of that crap.

To achieve financial freedom, and escape wage slavery, I just needed to eliminate my debt. Then I diversified my income streams and saved a 6 figure chunk of assets.

Now I sleep better than ever.

I built enough wealth and passive income in a few years. I know my family will never go hungry in a bad month.

This is where the book aligns with my own Do LESS system: Learn, Earn, Save and Sleep.

Rami method also emphasizes the importance of automatic savings and the power of compound interest. He encourages readers to save money in investment accounts rather than letting it sit idle in a checking account.

To me this is a no brainer, especially right now with interest rates going up. Set up alternative savings accounts online, and earn 4-5 percent on your savings while you sleep.

Everyone in America should ditch the standard Chase or Bank of America savings account. You could be earning hundreds of dollars a year, by having that first few thousand saved in a high interest savings account.

Ramit takes this high yield approach and levels it up with his concept of “conscious spending”.

This is basically budgeting for dummies— a do, don’t think model.

Spend money on things you love.

But cut costs mercilessly on things you don’t.

This is the part of the book, where I felt my blood pressure rising and wanted to go full rage mode and chuck it out the window.

The problem is that he says it’s cool to splurge on things you love, as long as you save 10%.

But this is crap advice. 10% is a fine starter goal for savings if you make minimum wage.

But if you are serious and making even a decent income, 20% is the bare minimum.

Even 30-40% of income going straight to your savings should be achievable.

He is basically gives a pass to higher earners. If you are in the same tax bracket as a seven figure earner like Ramit Sethi and his Manhattan dwelling friends, 10% of your income is going to turn into millions with compound interest.

But his advice to spend thousands care free screws over any of his readers with less disposable income.

This version of conscious spending is hypocritical. It ignores the beauty of compound interest.

He gives this insane example of a friend who spends $5000 a year on shoes.

Now, I’m a bit of a sneaker head and love a nice pair of high tops.

But five thousand bucks is five thousand bucks.

That’s more money than 10% of the average annual income in America.

The numbers don’t add up for most of his readers.

It’s like watching an old episode of Friends or Sex and The City and wondering how the hell everyone affords those beautiful Manhattan apartments.

The answer is simple: they’re living in a pipe dream. They can’t afford that lifestyle.

Let’s be real, you and I can’t afford to blow a hundred bucks a week on shoes.

Don’t just step on that cash. Invest your money in a low risk, broad based index fund.

If you don’t believe me, let’s run the numbers now.

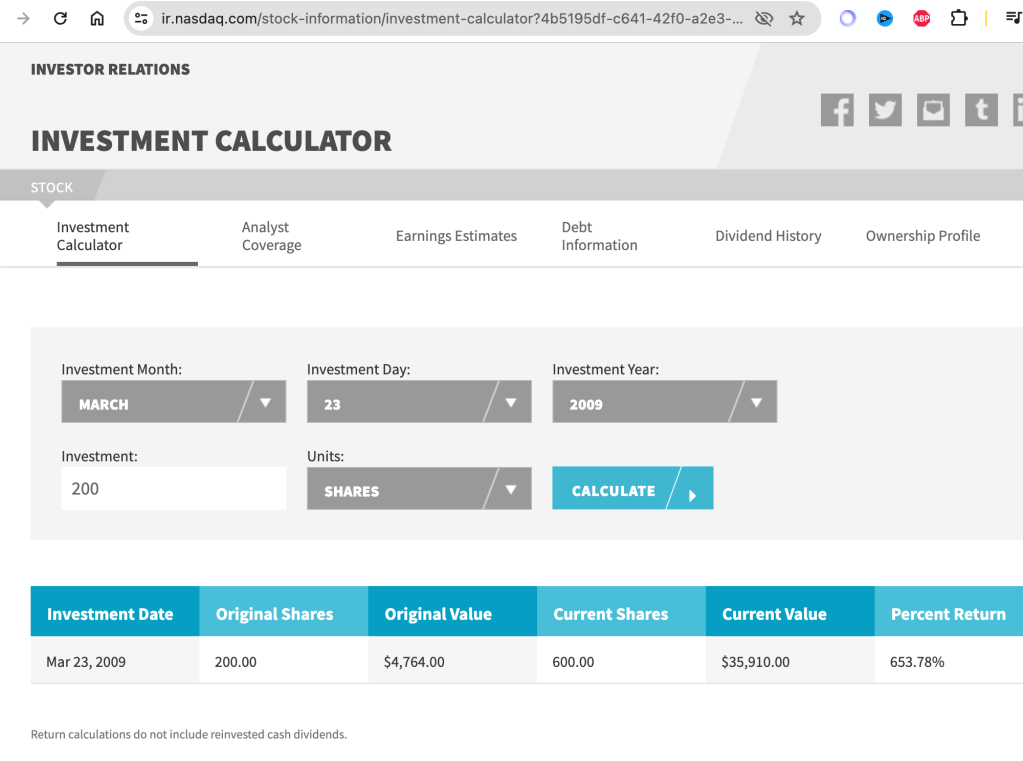

This book was published right after the financial crisis in 2009. March 23 to be exact.

Put that shoe money into Nasdaq, just a one time buy, not even an annual investment of $5000.

How much do you think you would have now?

35 thousand bucks! And a 653% return on investment.

Not counting dividends.

Not making a single deposit in the last 15 years.

So forget your friends shoes, Sethi.

You and I do Less and let our money do more. Save and invest your earnings, folks.

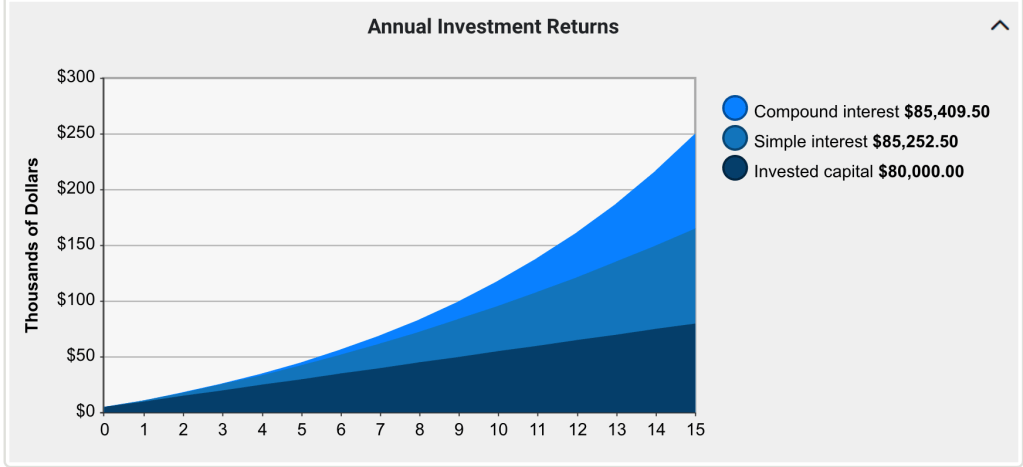

Now let’s run some more numbers and wonk out

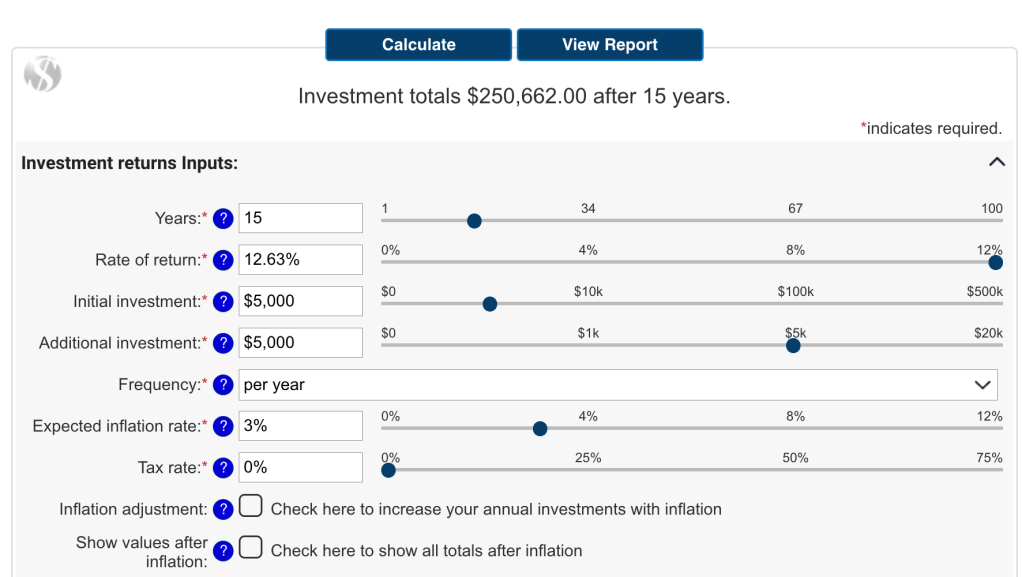

What about if we had put that five thousand into the S & P 500 in 2009, a classic index fund investment?

The average rate of actual returnhas been 12.63%.

So what would that shoe addict have earned in passive income, if she had ditched her vanity spending addiction?

Spoiler alert: investing 5k a year for the last decade and a half would have bagged you a big wad of green.

Now let’s add them all together and see what we get?

A quarter of a million friggin fraggin bucks. That’s no joke, folks.

How you like them pumps now?

I’m not kidding: are you?

The numbers don’t lie, folks.

2009-2023, save and invest $5000 a year in the S & P. Today you have a quarter million bucks in your account.

Now back to our schedule programming.

I will teach you to be rich.

What truly sets this book apart and makes it rereadable, for you and I, is the concept of the “rich life.”

Being rich is not necessarily about having a massive amount of wealth. It’s the financial freedom to spend your time and money on what truly matters to you.

Preach. Now I’m listening to what he is selling me.

This perspective can be eye-opening and life-changing for many readers, including you and I.

This mindset shift is what changed my life ten years ago. And it can change your rich life too.

My rich life is a nice house for my kids in our affordable beach community in sunny southeast Asia. Plenty of time to surf and cycle. Not to mention relax.

I can generate enough passive income in a 4 hour work week to sustain my lifestyle here for the rest of my days.

But your rich life might look different than mine.

You’ll have to run the numbers for your own version. Just like FIRE, this concept is customizable. That’s the beauty of the rich life.

Start by learning and writing down what you really want from life. Then download a financial planner and run your numbers.

But who is this new rich life actually for?

SCENARIO #1

Maybe you’re a retired school teacher in Florida.

You might define your “rich life” as having the freedom to spend your days volunteering at a local church or community center and taking trips to visit your grandkids.

To do this you could have automated your savings during the last decade at work, and invested wisely to create a nest egg. This would allow you to enjoy retirement without financial worry.

Your number could be two hundred thousand, or a half million. Less if you have a decent pension and own a home. In that case, you just need to account for your property taxes, and keep an emergency fund for hurricane season.

SCENARIO #2

Maybe you’re in your thirties working at a law firm in London.

You might see the “rich life” as being able to afford a flat downtown, go to shows and bars, and eat at 5 star restaurants for dinner.

By practicing conscious spending, you could cut back on unnecessary expenses. Take the tube to work. Ditch designer clothes and watches. If you do the math right, you can afford to live the good times in London.

This isn’t necessarily my idea of smart investing. The money drain that is London is my worst nightmare, for anything longer than a weekend. But this lifestyle is achievable with the new rich life plan in I Will Teach You to be Rich.

SCENARIO #3

Maybe you’re a family traveling full time and vlogging for additional income.

This goal is certainly not your standard FIRE retirement. It is not for everyone or forever. Maybe it’s just your next five year plan. But it is doable today.

You and your kids or sweetie can afford the once in a lifetime experience of immersing yourselves in new cultures for months at a time. Enjoy quality time together and share your experiences online to reach a broad audience.

There are plenty of people eager to learn and willing to support your travel costs. That means give you money, folks. The ad revenue of your fans eyeballs and the green backs they spend in your store.

The principles of automatic savings and conscious spending could ensure a steady stream of income for your travels.

Setup an account you don’t touch, in case of emergencies on the road. Allocate funds for learning. Spend only what you need on the necessary gear to improve your content. Then deliver consistent high value content in exchange for income.

Time to do LESS on your path towards a new rich life.

Thanks for reading.

I write copy & content. I teach courses. I show up everyday.

But I do LESS. Learn. Earn. Save. Sleep.

Leave a comment